«The Deficit Myth: Modern Monetary Theory and How to Build a Better Economy» a été ajouté à votre panier. Voir le panier

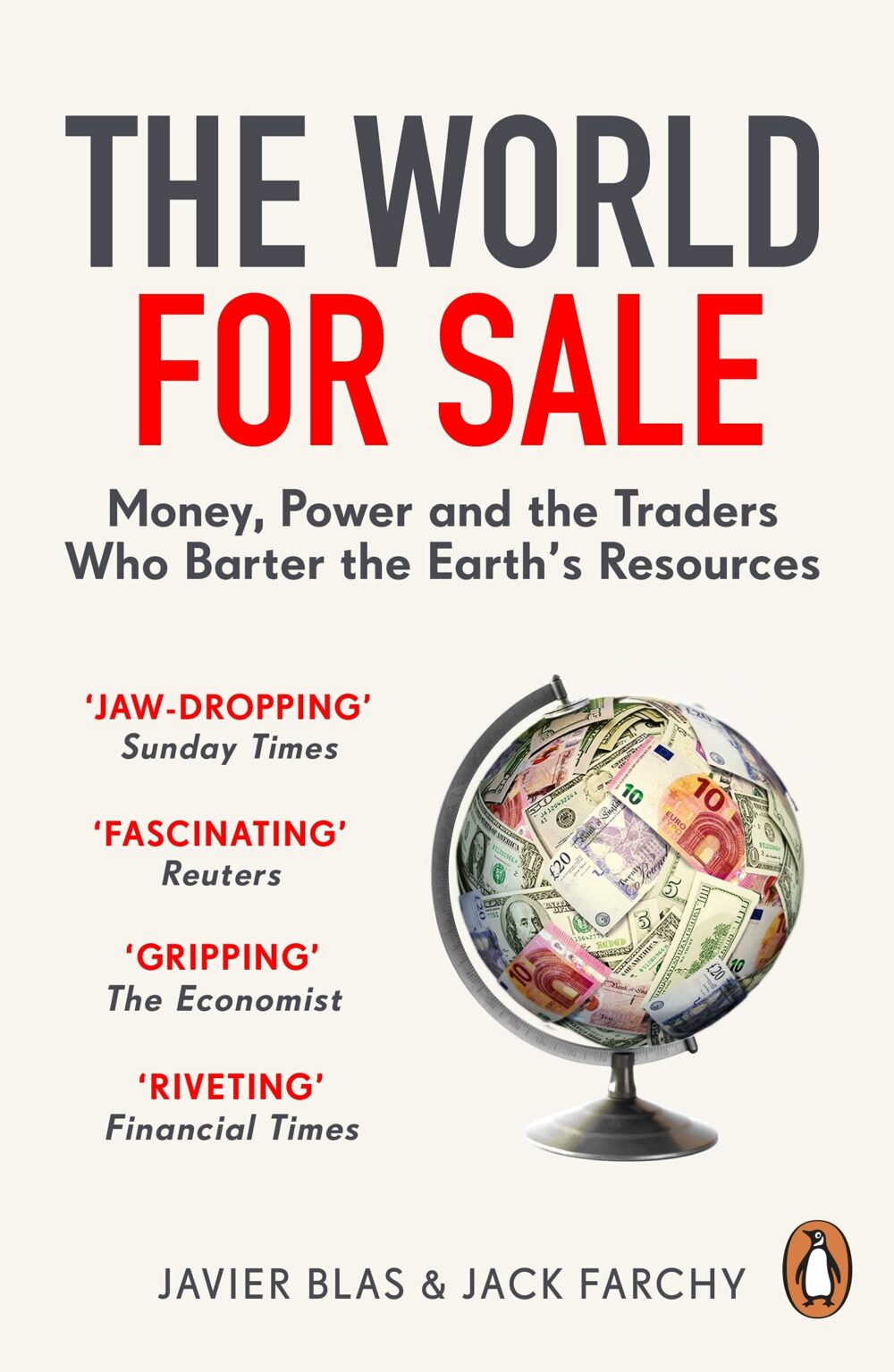

The World for Sale: Money, Power and the Traders Who Barter the Earths Resources

2.500,00 د.ج

The World for Sale Money Power and the Traders Who Barter the Earth’s Resources

9

Items sold in last 3 days

Ajouter 4.010,00 د.ج et bénéficier d'une livraison gratuite !

0

People watching this product now!

Estimated delivery dates: avril 13, 2025 – avril 20, 2025

Catégorie : Business

Description

The World for Sale Money Power and the Traders Who Barter the Earth’s Resources

Informations complémentaires

| Editeur |

|---|

Produits similaires

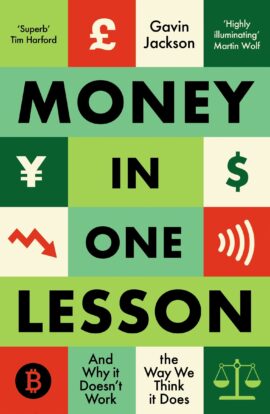

Money in One Lesson

2.530,00 د.ج

Superb' - Tim Harford, author of How to Make the World Add UpMoney is essential to the economy and how we live our lives, yet is inherently worthless. We can use it to build a home or send us to space, and it can lead to the rise and fall of empires. Few innovations have had such a huge impact on the development of humanity, but money is a shared fiction: a story we believe in so long as others act as if it is true.Money is rarely out of the headlines – from the invention of cryptocurrencies to the problem of high inflation, extraordinary interventions by central banks and the power the West has over the worldwide banking system. In Money in One Lesson, Gavin Jackson answers the most important questions on what money is and how it shapes our world, drawing on vivid examples from throughout history to demystify and show how societies and its citizens, both past and present, are always entwined with matters of money.‘A highly illuminating, well-researched and beautifully written book on one of humanity’s most important innovations’ – Martin Wolf, chief economics commentator, Financial Times

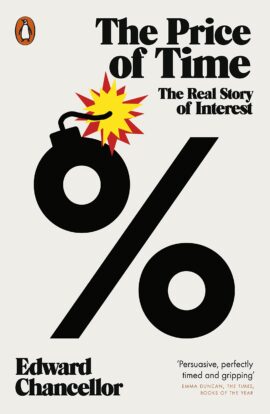

The Price of Time

1.950,00 د.ج

*Longlisted for the 2022 Financial Times Business Book of the Year Award*All economic and financial activities take place across time. Interest coordinates these activities. The story of capitalism is thus the story of interest: the price that individuals, companies and nations pay to borrow money.In The Price of Time, Edward Chancellor traces the history of interest from its origins in ancient Mesopotamia, through debates about usury in Restoration Britain and John Law ' s ill-fated Mississippi scheme, to the global credit booms of the twenty-first century. We generally assume that high interest rates are harmful, but Chancellor argues that, whenever money is too easy, financial markets become unstable. He takes the story to the present day, when interest rates have sunk lower than at any time in the five millennia since they were first recorded - including the extraordinary appearance of negative rates in Europe and Japan - and highlights how this has contributed to profound economic insecurity and financial fragility.Chancellor reveals how extremely low interest rates not only create asset price inflation but are also largely responsible for weak economic growth, rising inequality, zombie companies, elevated debt levels and the pensions crises that have afflicted the West in recent years - conditions under which economies cannot possibly thrive. At the same time, easy money in China has inflated an epic real estate bubble, accompanied by the greatest credit and investment boom in history. As the global financial system edges closer to yet another crisis, Chancellor shows that only by understanding interest can we hope to face the challenges ahead.

Money in One Lesson

2.530,00 د.ج

Superb' - Tim Harford, author of How to Make the World Add UpMoney is essential to the economy and how we live our lives, yet is inherently worthless. We can use it to build a home or send us to space, and it can lead to the rise and fall of empires. Few innovations have had such a huge impact on the development of humanity, but money is a shared fiction: a story we believe in so long as others act as if it is true.Money is rarely out of the headlines – from the invention of cryptocurrencies to the problem of high inflation, extraordinary interventions by central banks and the power the West has over the worldwide banking system. In Money in One Lesson, Gavin Jackson answers the most important questions on what money is and how it shapes our world, drawing on vivid examples from throughout history to demystify and show how societies and its citizens, both past and present, are always entwined with matters of money.‘A highly illuminating, well-researched and beautifully written book on one of humanity’s most important innovations’ – Martin Wolf, chief economics commentator, Financial Times

How to Teach Economics to Your Dog: A Quirky Introduction

2.300,00 د.ج

A fun take on some of the biggest questions in economics, made accessible for non-experts (and dogs)Monty is a dog, not a financial genius, but economics still shapes his everyday life.Over the course of seventeen walks, Dr Rebecca Campbell chews over economic concepts and investigates how they apply to our lives – people and mutts alike. There are no graphs, no charts (Monty can’t read them) and definitely no calculus!How to Teach Economics to Your Dog tackles the knotty question of what economics actually is. Is it a mathematical science like physics? Or a moral and philosophical investigation of how societies should manage scarce resources?Along the way we meet some of the great thinkers from Adam Smith to Thomas Piketty, and ponder questions such as: What on earth does quantitative easing mean? And why are some countries so much richer than others?

The Art of War: The Ancient Classic

2.760,00 د.ج

The original and bestselling leadership book!Sun Tzu's ideas on survival and success have been read across the world for centuries. Today they can still be applied to business, politics and life. The Art of Wardemonstrates how to win without conflict. It shows that with enough intelligence and planning, it is possible to conquer with a minimum of force and little destruction.While most of us will never find ourselves in real battle situations, we all need strategies to operate effectively in work, love and life, we need to be able to manage conflict, and we need to be skilled at dealing with people. The Art of War is a time-tested resource for 'victory' in each of these areas, and has been proven over time.This luxury hardback edition includes an introduction by Tom Butler-Bowdon that draws out lessons for managers and business leaders, and highlights the power of Sun Tzu's thinking in everyday life.

Safe Haven: Investing for Financial Storms

4.140,00 د.ج

What is a safe haven?What role should they play in an investment portfolio? Do we use them only to seek shelter until the passing of financial storms? Or are they something more? Contrary to everything we know from modern financial theory, can higher returns actually come as a result of lowering risk? In Safe Haven, hedge fund manager Mark Spitznagel―one of the top practitioners of safe haven investing and portfolio risk mitigation in the world―answers these questions and more. Investors who heed the message in this book will never look at risk mitigation the same way again.

The Deficit Myth: Modern Monetary Theory and How to Build a Better Economy

2.990,00 د.ج

THE INTERNATIONAL BESTSELLER'Kelton has succeeded in instigating a round of heretical questioning, essential for a post-Covid-19 world, where the pantheon of economic gods will have to be reconfigured' Guardian'Stephanie Kelton is an indispensable source of moral clarity ... the truths that she teaches about money, debt, and deficits give us the tools we desperately need to build a safe future for all' Naomi Klein'Game-changing ... Read it!' Mariana Mazzucato'A rock star in her field' The Times'This book is going to be influential' Financial Times'Convincingly overturns conventional wisdom' New York TimesSupporting the economy, paying for healthcare, creating new jobs, preventing a climate apocalypse: how can we pay for it all? Leading economic thinker Stephanie Kelton, shows how misguided that question is, and how a radical new approach can maximise our potential as a society. Everything that we've been led to believe about deficits and the role of money and government spending is wrong. Rather than asking the self-defeating question of how to pay for the crucial improvements our society needs, Kelton guides us to ask: which deficits actually matter?

Black Box Thinking

2.530,00 د.ج